Want to take advantage of a CU TAKE TEN RRSP® Loan?

- Look at your tax assessment notice to find out how much RRSP contribution room you have.

- Visit Unity Credit Union and take advantage of a CU TAKE TEN® RRSP Loan to maximize your contribution.

- Set up an affordible re-payment schedule with your Account Manager.

- Sit back, relax and watch your RRSP grow!

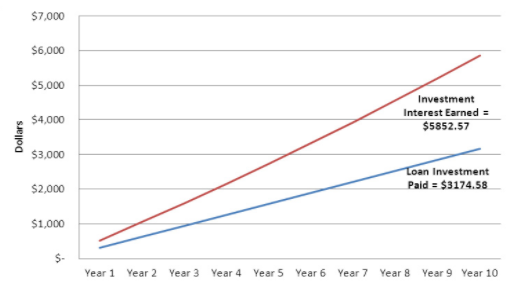

Borrowing to invest in your RRSP with the CU TAKE TEN® RRSP Loan is like a monthly savings plan, with the benefit of a lump-sum investment earning interest from day 1. At the end of the term, even though you have been paying interest on the loan, the interest earned on your investment will be greater, resulting in a net benefit for you.

Example: A $20,000 investment earning 2.60% for ten years, will earn $5,852.57 in interest. A loan for $20,000 at a rate of 3.00% over ten years will only cost you $3,174.58. This means that you would have a net benefit of $2,677.99.**

Search

Search